According to global internet usage statistics, a significant percentage of the global population surfs the Internet solely from the mobile phones. This underscores the importance of mobile applications for businesses aiming to expand their audience and increase revenue. By 2025, it is forecasted that the number of mobile internet users in the Gulf Cooperation Council (GCC) region will exceed 350 million.

The Importance of Mobile Apps for Businesses

Mobile apps are now an integral part of the average person's daily life. Used by tens of millions daily to make their purchases, complete money transfers, hail rides and communicate, there previously insignificant systems are now one of the key factor channels to build a company’s commercial success. Here are just five key benefits these apps bring companies:

-

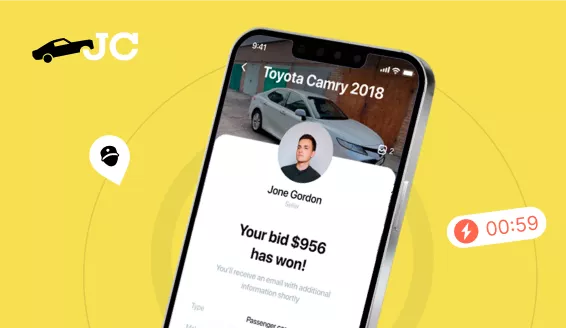

Fast pace sales: With a cell phone just in reach, a user’s next purchase is always just a few clicks away. This leads to faster sales cycles: from product discovery to the completed purchase.

-

Higher Conversion Rates: Apps often include loyalty programs, personalized experiences, and notifications, all of which build user engagement and increase the likelihood of both initial and regular purchases.

-

Competitive Advantage: Users will opt for the convenience and speed of app transactions over the slower and more cumbersome process of navigating a mobile website.

-

Expansion of Sales and Marketing Channels: Mobile apps open new ways to build brand notoriety and awareness, via things like push notifications, geolocation services, and integration with social media platforms.

-

Optimization and Automation of Business Processes: Apps automate payments, delivery, and order management, reducing the likelihood of errors in these separate fields while increasing operational efficiency.

Key Features of a Successful App

A successful mobile app should include:

-

Push Notifications: These can instantly inform users about new products, special offers, and promotions. However, it's crucial not to overuse this feature to avoid annoying your users.

-

Online Payment Options: User retention is higher when they can effortlessly make payments. It’s essential that the app supports various payment methods, such as credit cards, e-wallets, and buy-now-pay-later options.

-

Search and Filtering: This helps customers quickly find what they need, with options to filter by categories, price, ratings, and other criteria.

-

Social Media Integration: Allowing users to share content directly from the app to social media can attract new users and increase engagement.

-

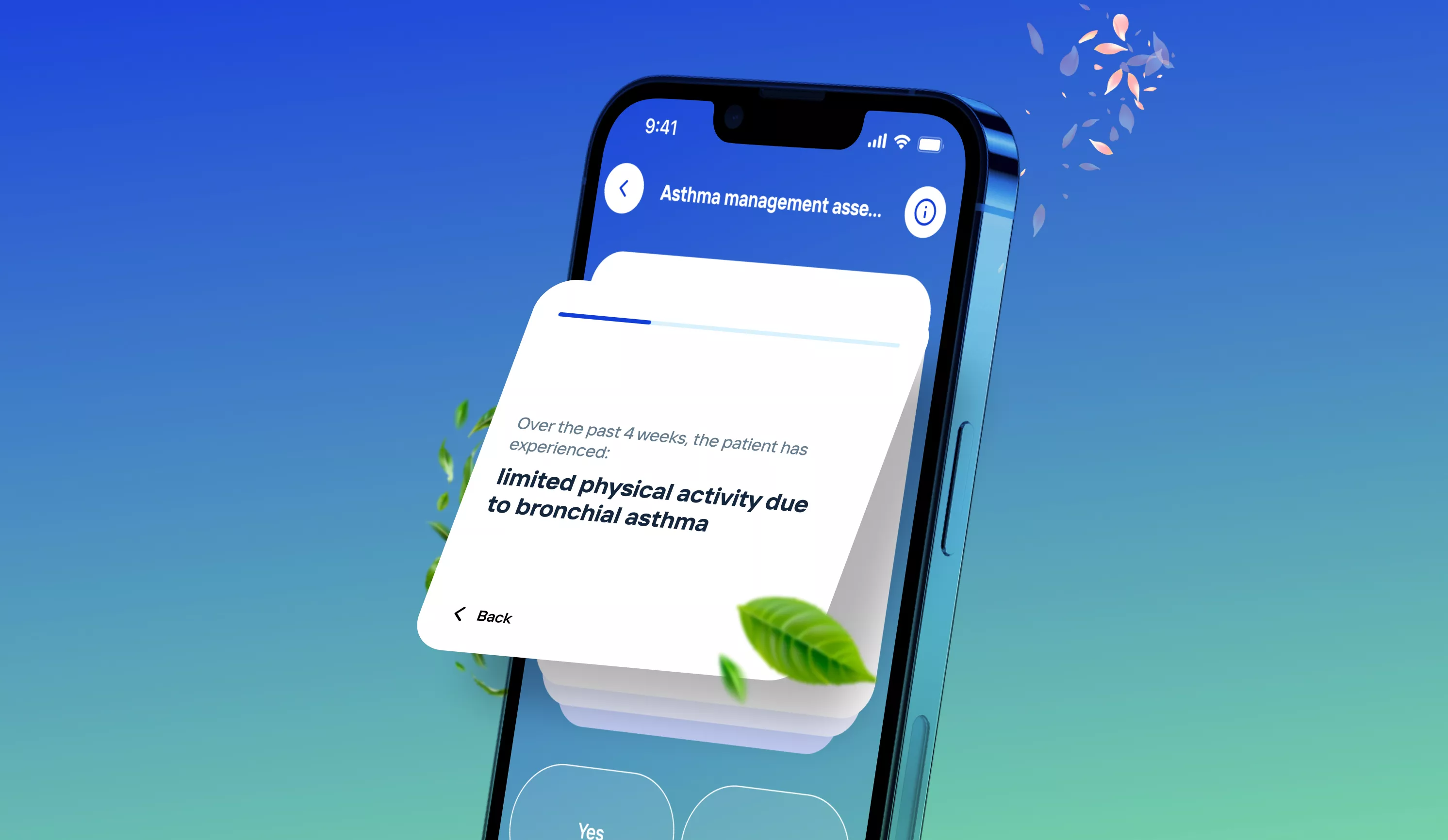

Customer Feedback and Support: This is vital for assisting users with their inquiries and issues, and it provides businesses with crucial data to enhance the app.

Does Every Business Require a Mobile App?

While many businesses benefit from having a mobile app, it’s not essential for all. Considerations include:

-

Limited Budget: Developing and maintaining a mobile app is costly. If funds are limited, investing in a responsive website might be more cost-effective.

-

Local Business Reach: Small, locally-focused businesses might engage their audience more effectively through other channels like social media or local e-commerce platforms.

-

Target Audience Preferences: If the target demographic is less inclined to use mobile apps, alternative engagement methods should be considered.

-

Infrequent Customer Interaction: For businesses that do not require frequent customer interactions, personal touchpoints or occasional direct contact may suffice.

Planning a Mobile App

Developing a mobile app requires careful planning and consideration of several factors:

-

Defining Business Goals: It's crucial to determine what the app aims to achieve, such as increasing sales, enhancing brand recognition, or introducing new services.

-

Functional Planning: Decide which features will be included in the initial launch and which can be added later down the line in newer editions.

-

Choosing the Right Platform and Technology: Whether choosing to develope a native app (specific to one operating system), a cross-platform app (serving multiple systems from one codebase), or a Progressive Web App (PWA) depends largely on the your budget, target audience and future business goals.

In Summary

A mobile app can be a significant driver of revenue for businesses looking to boost brand awareness, improve conversion rates, outpace competitors and streamline operations. The right approach to app development, coupled with a clear understanding of the business objectives and user needs are some of the key factors leading to successful outcomes.